Name:

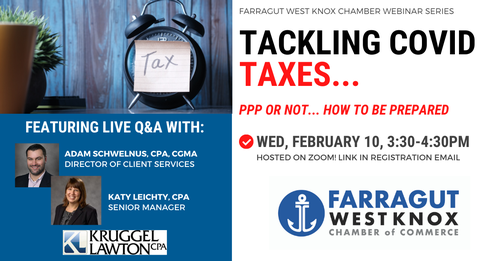

FWKCC Webinar: Tackling COVID Taxes

Date:

February 10, 2021

Time:

3:30 PM - 4:30 PM EST

Registration:

Register Now

Event Description:

On December 31st most of us said CHEERS to finishing 2020... but we're not done with it yet.

Whether your business took advantage of government aid like the EIDL or PPP... or not... COVID-19 and its many curveballs will still have impacts on your business. The way it could trip you up next? When you go to file your taxes this year.

We invite you to join us for this 1-hour webinar featuring experts from both the tax AND bookkeeping sides of accounting (because many small businesses do BOTH themselves still). They'll address some of the TOP things to watch out for AND we'll ask them to field as many of your questions as possible to help you be better prepared to file. Meet your panelists:

- Adam Schwelnus, CPA, CGMA, has over 10 years of experience in the administrative, managerial, and operational financial guidance for both private companies AND non-profits and focuses on the bookkeeping side of business. He has a diverse background of experience that makes him unique in his field, letting him anticipate people's/client's needs and give them tested solutions. Some areas he excels at are:

- Financial forecasts, analysis, and projections

- Budget development

- Internal control/risk analysis

- Project management and implementation

- Kate Leichty, CPA (Senior Manager) Adam Schwelnus, CPA, CGMA, has over 14 years of experience and works on the tax side of Kruggel Lawton's team. As a senior leader, Kate acts as:

- Lead delivery of tax services to clients

- Coaching and supervising professional staff

- A firm-wide resource on pass-through entities and state/local tax matters